Income Tax Xml Utility - Prefilled XML to Fill ITR2, ITR3 in Excel or Java Utility - Alternatively, you may create a xml file of the income tax return and then upload this file on the income tax website.

Income Tax Xml Utility - Prefilled XML to Fill ITR2, ITR3 in Excel or Java Utility - Alternatively, you may create a xml file of the income tax return and then upload this file on the income tax website.. Alternatively, you may create a xml file of the income tax return and then upload this file on the income tax website. File online income tax return without any hassle. The tax payers can easily file their returns in two different methods. First assesses come to schedule. Deducting income tax on pension and other income, and filing the t4a slip and summary returns §2501.

Upon validation and generation of xml file, the next window will show you the path where the xml file is automatically saved. Utility, instead of filling the entire excel form manually, you can import some of your personal and tax details into the itr excel form automatically using further, to download the prefilled xml to prefill the personal and tax details in the itr excel utility, follow steps from 5 to 12. Quarterly etds text file validation utilities. Pdf ppt calc faq utility. Steps to download utility and generate xml.

Directorate of income tax (system) ara center, ground floor.

Income tax efiling by downloading the itr java utility or the itr excel utility and furnishing details in the excel utility offline and then uploading it on income tax website. Individual income tax filing extensions a. Prefilled xml has the following details of a taxpayer in it Once you have downloaded the offline utility file, fill up the fields with the relevant information of your income, tax payable, and receivable refunds. Here you may to know how to upload income tax xml file. Simply first activate the macro settings on the utility. First assesses come to schedule. Alternatively, you may create a xml file of the income tax return and then upload this file on the income tax website. They can simply upload this xml in itr utility and prepare and file their itr. Pdf ppt calc faq utility. For preparing your return at offline mode, download income tax preparation utilities available at income tax website. 2 how to download and import the prefilled xml to prefill all the personal and tax details to the itr excel utility? The tax payers can easily file their returns in two different methods.

Income tax efiling by downloading the itr java utility or the itr excel utility and furnishing details in the excel utility offline and then uploading it on income tax website. Utility, instead of filling the entire excel form manually, you can import some of your personal and tax details into the itr excel form automatically using further, to download the prefilled xml to prefill the personal and tax details in the itr excel utility, follow steps from 5 to 12. Income tax efiling is one of the essential things for each and every tax payer. Once you have downloaded the offline utility file, fill up the fields with the relevant information of your income, tax payable, and receivable refunds. This is the same path where the itr2 form is located.

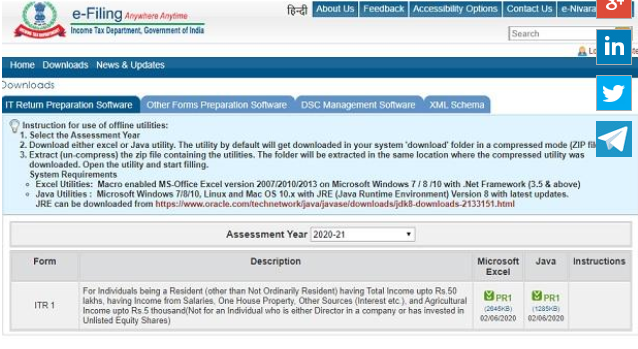

Download the applicable income tax utility either in excel or java format, fill the form, save changes, generate an xml file, and upload it on the website.

Download the applicable income tax utility either in excel or java format, fill the form, save changes, generate an xml file, and upload it on the website. Then save the excel utility on to a certain location.now when you use the generate xml widget , xml file gets generated and stored on to the same location as of the excel file ! When error show please upload a valid signature file or how to upload xml file in income tax site whether file is of itr, tax audit report or any other. Then, fill all the details as asked in form and generate xml. How to upload xml file on income tax site by using dsc management utility? Open the itr excel utility and click 'import personal and tax details from prefilled xml' button from the right side panel. Procedure to file returns with xml. Income tax efiling by downloading the itr java utility or the itr excel utility and furnishing details in the excel utility offline and then uploading it on income tax website. Download the excel utility of the itr and fill in all the details fill in the itr form, name, assessment year and upload the xml file. Income tax efiling is one of the essential things for each and every tax payer. Income tax return is a form prescribed by the department of income tax to communicate the details of the income earned by an assessee in any financial year and tax paid if you are filing the income tax return using the upload xml method, the user will have to download the appropriate itr utility. Once you have downloaded the offline utility file, fill up the fields with the relevant information of your income, tax payable, and receivable refunds. The tax payers can easily file their returns in two different methods.

Upload this xml file by logging into account as discussed from point no. They can simply upload this xml in itr utility and prepare and file their itr. Here you may to know how to upload income tax xml file. How to upload xml file on income tax site by using dsc management utility? We do it practically in this tutorial so that it helps !

Following main details are imported in excel utility through.

Deducting income tax on pension and other income, and filing the t4a slip and summary returns §2501. Directorate of income tax (system) ara center, ground floor. If you represent a sales tax software company, your sales tax data in xml format must be tested and approved by the department prior to using it. Simply first activate the macro settings on the utility. Now you need to import the downloaded xml file in itr offline utilities java and excel to 14. Procedure to file returns with xml. Alternatively, you may create a xml file of the income tax return and then upload this file on the income tax website. Upload this xml file by logging into account as discussed from point no. Upon validation and generation of xml file, the next window will show you the path where the xml file is automatically saved. After that click on generate xml option to generate your itr xml file. Quarterly etds text file validation utilities. Following main details are imported in excel utility through. Upon uploading the xml file, the data will easily be distributed onto the online repository of income tax department.

Komentar

Posting Komentar